Can You Negotiate CDN Prices?

The price you pay for a CDN will depend on different factors – primarily, the volume of bandwidth and requests, and of course, your negotiation strategy. We find that prices are negotiable, and that there are additional savings to be had if you execute negotiations correctly.

Our own data and experience indicates CDNs can offer lucrative discounts of up to 50-60%

Our data indicates that CDNs can offer discounts of up to 50-60%. This raises the question – how do you get the best price for your CDN? The short answer, with the right negotiation strategy and leverage.

The key to negotiating deals effectively is to have leverage, or some ground to stand on. Here are our tips.

Give yourself enough time

Too many times do we see organisations leave a negotiation to the last minute.

Time is often overlooked as a useful tool in a negotiation strategy. Not only can it be used to your advantage, but if you don’t use it wisely, it will be used against you.

First, you need to give yourself enough time to research and build your case. Second, negotiating over longer periods of time signals that you are serious and that a vendor can lose your business- this is your leverage.

For renewals, we typically recommend starting 3-4 months in advance. For new tools, we recommend 2-3 months ahead of a go-live date.

Finally, it never hurts to keep vendors on their toes – this indicates that you are serious and professional about having a competitive solution. This doesn’t mean you need to complain about their service, or tell them how expensive they are. Instead, you can demonstrate your understanding of the market and that there are alternatives out there.

Know Your BATNA

What they don’t want you to know:

Pricing can change based on the competitors being considered in an evaluation. For example, when expensive competitors are in the mix, prices will generally be higher, and when low-cost competitors are in the mix, prices will be lower.

The best negotiation strategy involves objectively understanding where a current deal sits in comparison with the next best alternative. And using this knowledge to leverage your negotiation position.

In negotiation theory, this is referred to as your BATNA – Best Alternative to a Negotiated Agreement, and it’s often your greatest source of power. Information about your next best alternatives will help you assess the quality of a proposal.

If your BATNA is based on reliable and accurate data, this can massively strengthen your position because you can base your negotiation on facts, which are much harder for vendors to overcome.

For CDNs, we recommend collecting quotes from 3-5 different vendors. Openly communicate your plan to compare vendors. This will add competitive pressure from the get go, letting the vendors know they need to put their best foot forward.

Benchmark 4-5 CDN Providers

What should you do?

1. Pick 4-5 CDN providers and gather quotations

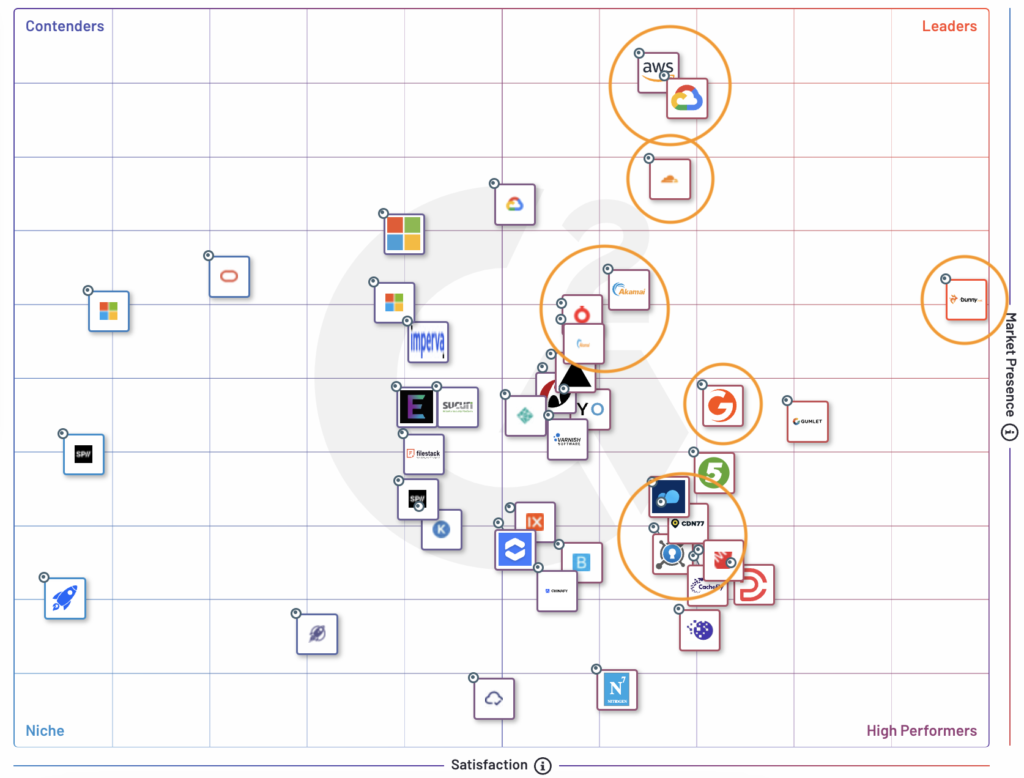

We recommend using G2 to assess what other tools can be considered a next best alternative. For CDNs, we would recommend the following; AWS CloudFront, GCP CDN, Akamai, Cloudflare, BunnyCDN, Fastly, GCore, and CDN77. These represent a good mix of high quality providers with varying price points.

2. Evaluate each quote – unpack them to figure out what is influencing price

Try to work out what vendors will offer if you adjust the usage commitment up or down. This should give you insights into the mechanics of the pricing, and what the sweet spot might be. This is where you can find an opportunity to sharpen your deal.

3. Clearly communicate to each vendor that they are being benchmarked

Often the most effective negotiation tool is to openly share what other vendors are offering, and then asking to match or beat them. Leaving enough time to negotiate is important because these types of conversations can involve multiple stakeholders and go back-and-fourth for some time.

This is where CloudCost Consulting comes in – we know what to negotiate, and how.

Understand Pricing Metrics: Volume, Requests, & Geographic Distribution

Work out a CDNs pricing model and what key metrics influence it. A lot of vendors will keep their pricing unknown, this makes it challenging to figure out what really defines price. This is a close guarded secret, however, there are ways to gather data to strengthen your position.

“If you know the enemy and know yourself, you need not fear the result of a hundred battles” – Sun Tzu

Contract Lengths & Payment Terms

For CDNs, you will typically get asked for two metrics: bandwidth and compute:

- # of Terabytes/Petabytes per month

- # of Requests per month

In addition to this, there might be other metrics to consider like the number of domains, or specific usage functions. However, ultimately, CD pricing is driven by Bandwidth and Requests.

Many CDN providers will apply generic geographic distribution for deals under a specific volume threshold (i.e. 500 terabyte or 1 petabyte per month). They generally base the geo distribution on the averages of their customers.

If you are over a certain threshold, geographic distribution of CDN traffic gets accounted for because CDN providers want to protect themselves from making a loss on a deal. This is because Internet bandwidth doesn’t cost the same every where in the world. For example, the low cost regions are found in North America and Europe. Some of the more expensive are Taiwan, South Korea, and India.

Our recommendation if you are negotiating a CDN deal is to workout what your geographic distribution is first. If a generic distribution is applied, you have an opportunity to improve your position by re-aligning the regions to reflect reality. This is an advantage to fine tune the distribution and avoid overpaying.

In our experience, the execution of this conversation will either lead the buyer to gain an upper hand, or if executed badly, the seller can gain an advantage. That’s where we come in to help organisations manage this effectively.

Furthermore, discounted prices can be found for longer subscription lengths – annual or multi-year. The same can be true for payment terms (monthly, quarterly, bi-annual, annual).

Watch out: vendors will generally present the default contract length and payment term. This may appear non-negotiable, but you will be surprised by how many variations can actually be explored.

According to our data, SaaS vendors will offer 3-5% discounts for each additional year a customer signs up for, and roughly the same when moving to fewer billing cycles.

The downside with negotiating these items is that often something needs to be compromised. For the contract length, you need to be confident in the longevity of the tool in your technology stack. For payment terms, this impacts cashflow.

Our recommendation is to figure out what the ideal scenario is before starting the negotiation. This way you work towards your objective, and you can lead the negotiation, rather than being led by the vendor’s sales representative.

Commitment Versus Overage Fees

With CDN deals, pricing will always be more competitive if you commit to specific levels of traffic for a given time period, versus paying for traffic based on actual consumption.

There are some CDN providers that offer a pure usage-based pricing model – where you pay for what you use. However, not all offer this. If you come across a CDN that requires a minimum usage commitment, it is possible to negotiate a low monthly commitment (aka cap), and then pay overages.

Beware the overages will carry a premium, 10% to 50% more. It’s worth noting, this is also negotiable.

How CloudCost Consulting Can Help

In summary, we covered some of the factors driving CDN pricing, and how to optimise costs. While data and insights serve as a valuable starting point for negotiations, the true essence lies in the execution; understanding what actions to take and how how to navigate the process is paramount for a successful negotiation.

Our team has +12 years of SaaS sales experience and has negotiated thousands of contracts from the other side of the table. We know what to negotiate and how. If you would like our support negotiating your next SaaS contract, please Contact Us.